|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Filing Bankruptcy Chapter 13: What You Need to Know

Filing for bankruptcy is a significant decision, and understanding the specifics of Chapter 13 bankruptcy can help you make an informed choice. This article explores the benefits, process, and frequently asked questions about Chapter 13 bankruptcy.

Understanding Chapter 13 Bankruptcy

Chapter 13 bankruptcy, also known as a 'wage earner's plan,' allows individuals with a regular income to develop a plan to repay all or part of their debts. This type of bankruptcy enables debtors to keep their property and pay debts over time, usually three to five years.

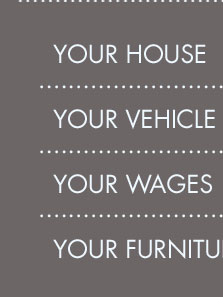

The Benefits of Chapter 13 Bankruptcy

- Asset Protection: Unlike Chapter 7, Chapter 13 helps you keep your assets while reorganizing your debts.

- Debt Consolidation: It allows you to consolidate debts into one manageable payment.

- Stopping Foreclosure: Chapter 13 can halt foreclosure proceedings and allow you to catch up on missed mortgage payments.

Eligibility Criteria

To file for Chapter 13 bankruptcy, individuals must meet certain criteria, including having a regular income and unsecured debts less than $419,275 and secured debts less than $1,257,850. These limits are adjusted periodically to reflect changes in the consumer price index.

The Chapter 13 Bankruptcy Process

The process begins with filing a petition with the bankruptcy court, along with a detailed plan to repay creditors over time. It's crucial to work with a legal expert, such as a bankruptcy attorney in Greensboro, NC, to ensure all necessary paperwork is accurately completed.

Developing a Repayment Plan

- Assessment: Evaluate your financial situation to determine a feasible repayment plan.

- Submission: Submit the repayment plan to the court for approval.

- Implementation: Begin making payments according to the court-approved plan.

Throughout this process, debtors are protected from creditors' collection actions, giving them the necessary time to reorganize their finances.

Life After Chapter 13 Bankruptcy

Completing a Chapter 13 plan can lead to a brighter financial future. Successfully adhering to the repayment plan results in the discharge of remaining eligible debts, helping you regain financial stability. A successful discharge can also improve your credit score over time.

Building a Strong Financial Future

Post-bankruptcy, it’s important to maintain financial discipline. Creating a budget, monitoring your credit report, and seeking financial advice from professionals, such as a bankruptcy attorney in Hillsboro, Oregon, can aid in building a robust financial future.

Frequently Asked Questions

What happens to my credit score after filing Chapter 13 bankruptcy?

Filing for Chapter 13 bankruptcy will initially lower your credit score. However, as you make consistent payments under the repayment plan, your credit score can improve over time.

Can I include all my debts in a Chapter 13 plan?

Most debts can be included in a Chapter 13 plan. However, certain debts, such as child support, alimony, and some tax obligations, cannot be discharged.

Is it possible to pay off a Chapter 13 plan early?

Yes, it is possible to pay off a Chapter 13 plan early. However, doing so may require you to pay the full amount of your debts, not just the percentage initially agreed upon.

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts.

1. Complete credit counseling. You can't file for any type of bankruptcy until you've completed a credit counseling course within the last 180 days.

To qualify for Chapter 13, you must have regular income, have filed all required tax returns for tax periods ending within four years of your ...

![]()